- Assets buy freedom; liabilities buy stress.

- Tax, debt, and cash flow literacy separate the rich from everyone else.

Book Summary

| Language | English (400) |

|---|---|

| Published On | 2017 (4) |

| Timeperiod | 21st Century (185) |

| Genre | finance (6), nonfiction (88) |

| Category | Wealth (44) |

| Topics | assets (3), cash flow (1), debt (1), financial education (1) |

| Audiences | employees (9), entrepreneurs (119), investors (33), students (282) |

Table of Contents

- What’s Inside Why the Rich Are Getting Richer

- Book Summary

- Chapter Summary

- Why the Rich Are Getting Richer Insights

- Usage & Application

- Life Lessons

- FAQ

- Famous Quotes from Why the Rich Are Getting Richer

What’s Inside Why the Rich Are Getting Richer

Synopsis

A practical guide explaining how the rich use assets, tax advantages, leverage, and cash-flow strategies, backed by Rich Dad principles to build lasting wealth and financial independence.

Book Summary

- Wealth comes from buying assets that pay you, not income alone.

- Tax rules reward investors and business owners who understand the code.

- Good debt can accelerate wealth; bad debt drains cash flow.

- Cash-flow literacy is the core of real financial education.

- Mindset shifts drive behavior, and behavior drives net worth.

Chapter Summary

Chapter 2: Financial Education Matters – True wealth begins with learning how money really works.

Chapter 3: The Cashflow Quadrant – Moving from employee or self-employed to business owner or investor changes your financial destiny.

Chapter 4: The Power of Leverage – The rich use other people’s time, money, and knowledge to multiply results.

Chapter 5: Taxes and Debt – The wealthy understand and use tax laws and good debt to their advantage.

Chapter 6: The School System’s Failure – Traditional education trains workers, not financially free individuals.

Chapter 7: Mindset Over Money – Wealth begins with thinking differently about risk, failure, and opportunity.

Chapter 8: Building and Buying Assets – Focus on acquiring income generating assets instead of liabilities.

Chapter 9: The New Rules of Money – The digital age rewards financial intelligence, creativity, and adaptability.

Chapter 10: The Future Belongs to the Financially Educated – Those who keep learning about money will thrive, no matter how the world changes.

Why the Rich Are Getting Richer Insights

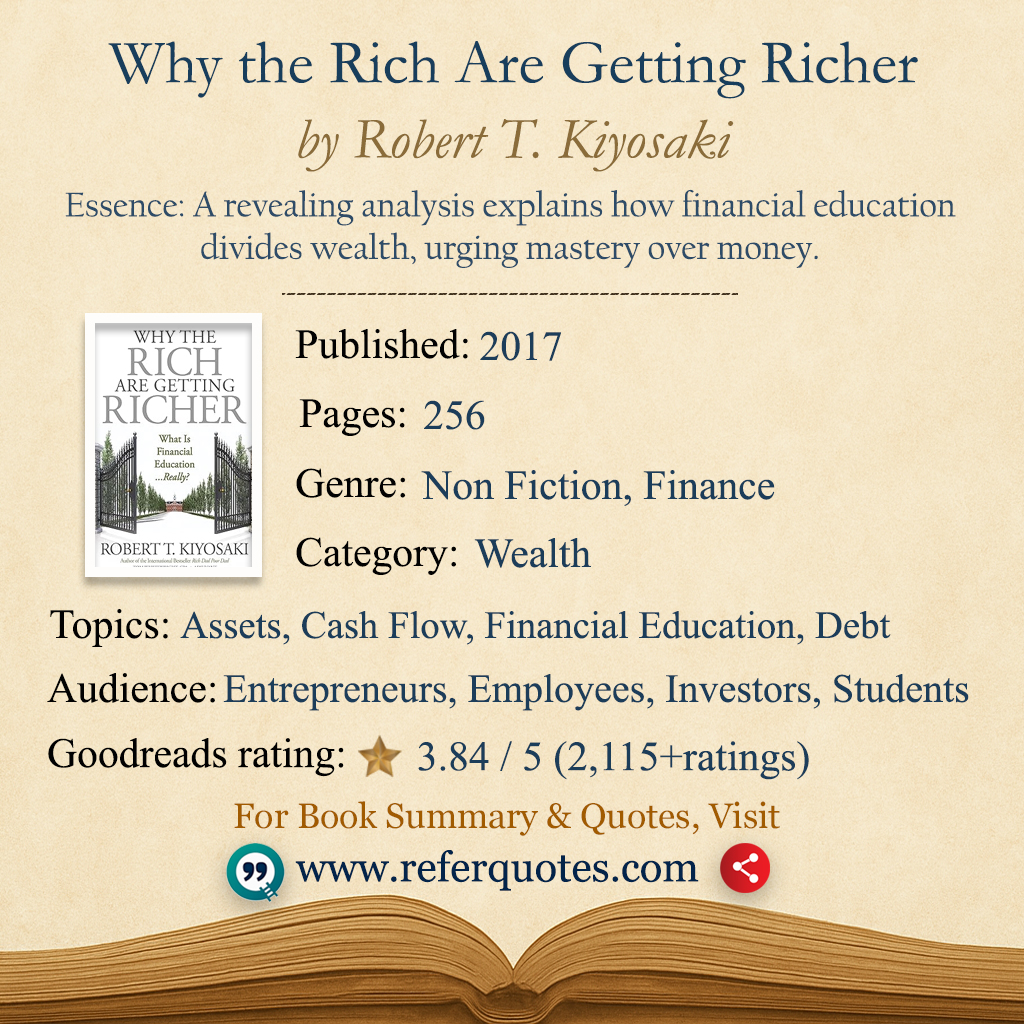

| Book Title | Why the Rich Are Getting Richer |

| Book Subtitle | What is financial education... really? |

| Author | Robert T. Kiyosaki |

| Publisher | Plata Publishing, LLC |

| Translation | Not applicable (originally published in English) |

| Details | Publication Year/Date: 2017, ISBN/Unique Identifier: 9781612680811, Last edition: 1st Edition, Number of pages: 256 |

| Goodreads Rating | 3.84 / 5 – 2,115 ratings – 236 reviews |

Usage & Application

How to Use This Book

Here’s how to put the book’s ideas to work fast.

1) Career pivot: If you’re a high-earning employee with little savings, build a 12-month plan to convert 10–20% of your income into cash-flowing assets (e.g., index funds, REITs, or a small service business). Track monthly cash flow and reinvest profits.

2) Small business owner: Use the book’s tax and entity insights to separate personal and business finances, then systemize cash flow with a weekly scorecard (revenue, expenses, net cash). Redirect surplus into assets that reduce tax while producing income.

3) Debt triage: Refinance high-interest consumer debt, then redeploy freed-up cash to buy assets with positive cash-on-cash returns. Start small, iterate monthly, and scale only what consistently pays you. The goal isn’t fancy, just predictable cash flow that compounds.

Video Book Summary

Life Lessons

- Wealth is measured in months of survivability from cash-flowing assets, not salary size.

- The tax code is a set of incentives; learn them and align your behavior accordingly.

- Leverage is neutral, used wisely, good debt multiplies asset-building.

- Financial education is practical: read statements, manage cash flow, buy assets.

- Mindset shifts precede money shifts; beliefs drive financial behavior.